50 Beale Street San Francisco Charge On Credit Card – Guide!

If you’ve ever glanced at your credit card statement and noticed a charge from “50 Beale Street San Francisco,” you might have wondered what it signifies.

“50 Beale Street San Francisco” charge on credit card statements, particularly its association with transactions made through Instacart. This charge is typically legitimate and is related to temporary authorization holds placed by Instacart on your account.

This article aims to demystify this common occurrence, shedding light on why this charge appears, its association with Instacart transactions, and steps to take if you’re unsure about its legitimacy.

What Is The 50 Beale Street Charge? – Discover The Truth Behind!

The 50 Beale Street San Francisco charge on your credit card statement might initially raise eyebrows, but fear not—it’s often linked to transactions made through Instacart, a popular grocery delivery service. Instacart’s headquarters is at 50 Beale Street in San Francisco, hence the address on your statement.

Why Does It Appear? – Unravel The Reasons Behind This Common Occurrence!

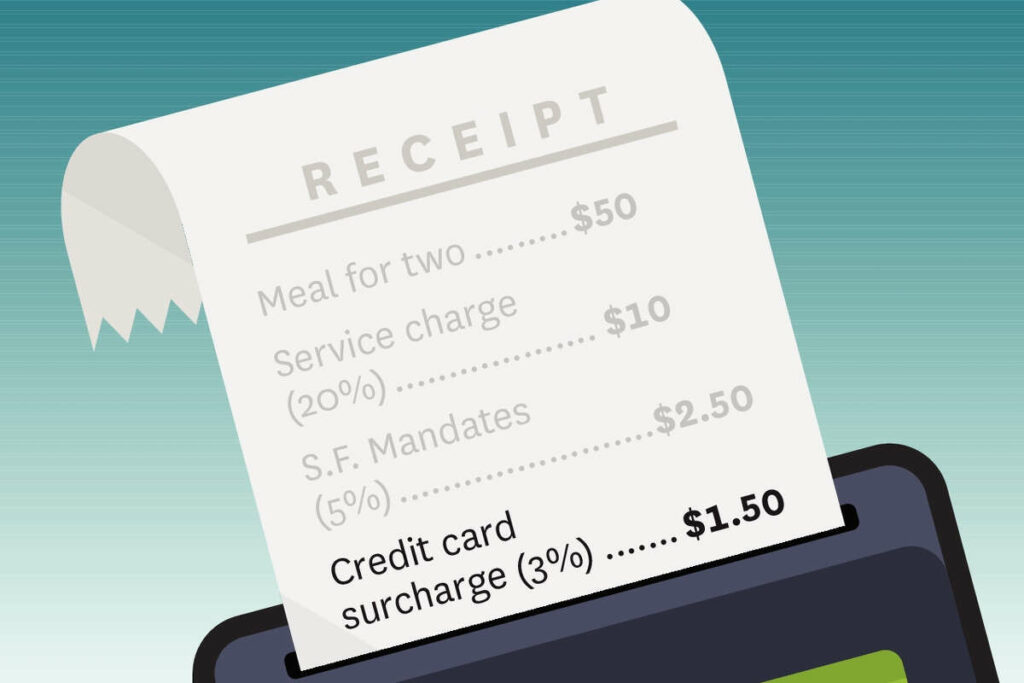

When you purchase Instacart, the company places a temporary authorization hold on your account. This hold sometimes reflected as the “50 Beale Street San Francisco” charge, is typically higher than your total purchase amount. It’s intended to cover potential additional charges, such as tips or replacements for out-of-stock items.

Understanding Authorization Holds – Learn How To Navigate Authorization Holds!

Authorization holds are a standard practice within the banking industry that temporarily reserves a portion of your credit or debit account balance while a transaction is being processed or finalized.

These holds are commonly encountered when making purchases with credit or debit cards, particularly in situations where the final transaction amount is uncertain at the time of authorization.

How Authorization Holds Work

When you make a purchase, such as at a retail store or online, the merchant requests authorization from your bank to ensure that you have sufficient funds available for the transaction.

During this process, the bank places a temporary hold on the authorized amount, effectively setting aside those funds from your available balance.

Duration Of Authorization Holds – Protect Your Finances And Stay Informed!

Authorization holds typically last for a predetermined period, which can vary depending on the merchant and the policies of your bank or card issuer.

In most cases, holds are released once the transaction is finalized, and the actual amount is charged to your account. However, the duration of holds can range from a few hours to several days.

Managing Authorization Holds – Take Charge Today!

While authorization holds are a routine part of card transactions, it’s essential to be aware of their potential impact on your available funds. Here are some tips for managing authorization holds effectively:

- Monitor Your Account: Regularly check your bank or credit card statements to track pending transactions and ensure that holds are released promptly after transactions are finalized.

- Budget Accordingly: Account for pending authorization holds when managing your finances to avoid overspending or overdrafts.

- Communication with Merchants: If you encounter any discrepancies or unexpected holds, communicate with the merchant or contact your bank for clarification and resolution.

Identifying Potential Fraud – Stay Vigilant And Protect Your Finances!

Identifying potential fraud is crucial to safeguarding your financial security and protecting yourself from unauthorized transactions. Here’s what you need to know:

1. Unfamiliar Charges:

If you notice a charge on your credit card statement that you don’t recognize, it’s a red flag for potential fraud. Take a closer look at the transaction details to determine its legitimacy.

2. Discrepancies in Amounts:

Check if the amount of the charge matches your recent transactions. If the amount seems unusual or doesn’t align with your purchase history, it could indicate fraudulent activity.

3. Review Transaction Details:

Examine the transaction details, such as the merchant’s name, date, and location. Look for any discrepancies or inconsistencies that may signal fraudulent behavior.

4. Monitor Account Activity:

Regularly monitor your credit card account for any unauthorized transactions or suspicious activity. Set up alerts or notifications for unusual charges to receive immediate alerts and take prompt action.

Steps To Take If You Notice The Charge:

If you’ve noticed the “50 Beale Street San Francisco” charge on your credit card statement and are unsure about its legitimacy, it’s crucial to take immediate action to protect yourself from potential fraud. Here are the steps to follow:

1. Review Your Recent Transactions:

Take a moment to review your recent transactions and receipts to determine whether the charge aligns with any purchases you’ve made.

If you’ve used Instacart recently, it’s likely that the charge is legitimate. However, if you haven’t used Instacart or if the charge amount doesn’t match your records, proceed with caution.

2. Contact Your Credit Card Provider:

Reach out to your bank or credit card issuer as soon as possible to report the suspicious charge. You can usually find a customer service number on the back of your credit card or on your monthly statement.

Inform them about the unauthorized charge and provide any relevant details, such as the date and amount of the transaction.

3. Follow Up:

Follow up with your credit card provider to ensure that the unauthorized charge has been resolved satisfactorily.

They should investigate the matter and, if appropriate, issue a refund for the fraudulent transaction. It’s essential to stay proactive and persistent until the issue is fully resolved.

FAQs (Frequently Asked Questions):

1. I’ve never used Instacart. Should I be concerned about the 50 Beale Street charge?

If you haven’t made any transactions with Instacart, it’s advisable to treat the charge as suspicious and take necessary actions to safeguard your account.

2. How long does the 50 Beale Street charge typically appear on my statement?

The charge may appear temporarily as an authorization hold and usually disappears within a few days. However, the actual duration may vary depending on your bank’s policies.

3. Can I dispute the 50 Beale Street charge if I believe it’s fraudulent?

Yes, you can dispute any unauthorized or fraudulent charges with your credit card provider. Contact them immediately to report the charge and initiate the dispute resolution process.

Conclusion:

The 50 Beale Street San Francisco charge on your credit card statement is often associated with Instacart transactions and temporary authorization holds. While it’s typically legitimate, verifying any unfamiliar charges is essential to protect yourself from potential fraud.

By understanding the nature of these charges and taking proactive steps, you can ensure the security of your financial information and enjoy peace of mind when reviewing your credit card statements.

Read: